The estate plan might then include a buy sell agreement. Business succession planīusiness owners can lay out their business succession plan, having discussed it with all relevant parties and received buy-in. This can be as general or as specific as you wish. Part of your estate plan can include funeral, burial and related arrangements. The living will can be fortified by and would reflect any medical power of attorney. You can also designate someone to make decisions for you. Living willĪ living will, or advance health care directive, spells out your wishes for medical treatment when you cannot make or communicate those decisions yourself. The plan also can provide for compensation for taking on what usually is a demanding role. You will name someone you trust who has agreed to shoulder the responsibility. ExecutorĪn estate plan should name an executor who will carry out your plan. You can grant general powers or powers of attorney for specific needs, such as a financial power of attorney to make financial decisions only or a medical power of attorney. This person does not have to be an actual attorney but would be your attorney in fact. You should decide whether you would like a general power of attorney to act on your behalf. You might consider establishing a trust to provide for their education or a revocable living trust that a guardian can use for their needs. It is essential to decide who will take care of your dependents and to provide for their financial well-being. These include life insurance policies and retirement accounts. You should also name the beneficiary for all policies you hold that will pay funds after you pass. Put a name to all personal property, physical assets, real estate and intangible assets, such as patents and digital assets. This includes all financial accounts, such as investment accounts, savings accounts, brokerage accounts, mutual funds, and stocks. Next, decide who will get what, including property distribution and financial assets. You can even make beneficiaries joint owners of assets like a vacation home. You can leave money or physical assets to friends, neighbors, a charity or even pets. This can be close family members or distant relatives. BeneficiariesĪs a starting point, you should consider who will be a beneficiary of your estate. Once you have your goals for estate planning, it is time to start making decisions about your estate. Then, before you meet with an advisor, you need to make a few lists of vital information. First, you have some important decisions to make. Before you can do that, however, you need to address a few other matters. If you aren’t well-organized, one goal might be to gather all your legal documents and estate planning documents.

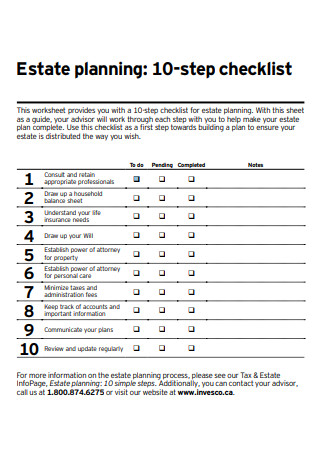

Make sure beloved personal possessions and real estate holdings are passed to the desired parties and prevent disagreements.Ensure the financial well-being of minor children and other family members.It helps to be clear about them before meeting with an estate planning attorney, financial professionals, or others who may play a role in your estate planning process. Most everyone has goals for estate planning. Nearly everyone has an estate, and every estate is unique. This article will give you an idea of what an estate plan entails. Perhaps you are thinking about estate planning due to a big life event, like having a child or a serious illness. This planning checklist can also be used for informational purposes by anyone who is interested in estate planning basics.

#Estate planning checklist update#

It also will make it easier to carry through with, maintain and update your estate plan. Using the estate planning checklist in this article will help you get ready for estate planning. Putting in a little effort upfront is well worth the effort. It also will help ensure that you get the best advice possible. Once you have taken the first step and made an appointment with an expert in estate planning, there are several things you can do to make the most of your first meeting.īeing prepared will help make the process go more smoothly and quickly. One of the best gifts you can give family members when you pass away is a well-made estate plan. That’s where a good estate planning checklist comes into play.

0 kommentar(er)

0 kommentar(er)